When you fill a prescription for a generic drug, you might expect the same price no matter where you live. But if you’ve ever compared the cost of generic atorvastatin or metformin in Canada versus the U.S., you’ve probably noticed something strange: Canada’s generic drugs often cost more than America’s-even though Canada has a publicly funded healthcare system. How does that make sense? The answer lies in two very different systems, built on opposite philosophies.

Canada Controls Prices, the U.S. Lets the Market Decide

In Canada, drug prices aren’t left to chance. The pan-Canadian Pharmaceutical Alliance (pCPA), made up of provincial and territorial health ministers, negotiates prices for both brand-name and generic drugs on behalf of public drug plans. These plans cover about 42% of all outpatient prescriptions. The pCPA doesn’t just set one price-it uses a tiered system. If a drug has multiple manufacturers, it gets a lower price. If only one company makes it, the price goes up. This system started in 2010 and was updated in October 2023 to keep squeezing out waste. In the U.S., there’s no federal price control on generics. Once a patent expires, any manufacturer can make the drug. The more companies that jump in, the lower the price drops. It’s pure competition. After the first generic enters the market, prices can fall 80-90% within six months. That’s why you can get 90 days of generic lisinopril for $4 at Walmart in some states. In Canada, the same drug might cost $35-$50, even with public coverage.Why Are Canadian Generic Prices Higher?

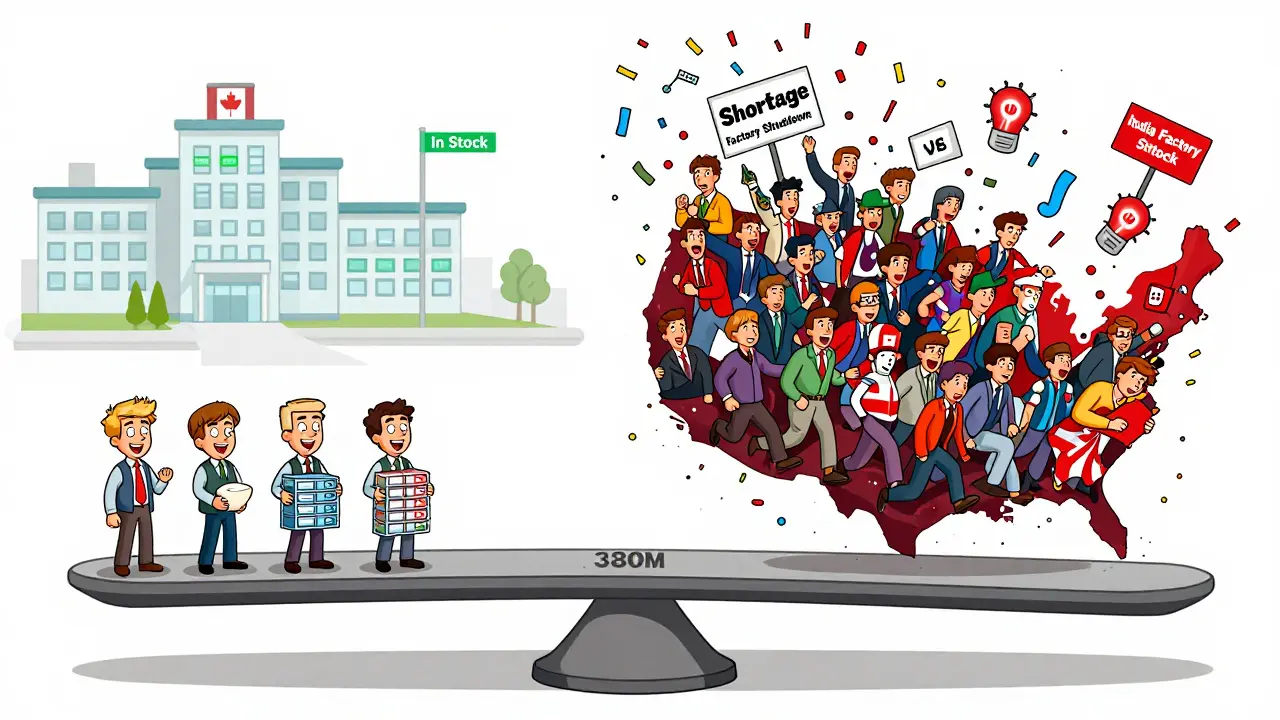

It sounds backwards, right? A country with universal healthcare pays more for generics than one without? The reason is simple: Canada doesn’t regulate generic prices the way it does for brand-name drugs. The Patented Medicine Prices Review Board (PMPRB) keeps brand-name drug prices in check. But once a drug loses its patent, it’s no longer under PMPRB’s watch. That created a loophole. Manufacturers saw an opportunity: if they couldn’t make big profits on patented drugs, they’d focus on generics. And because Canada’s market is small-just 38 million people-they didn’t need many competitors. So a few companies dominated, and prices stayed high. Meanwhile, in the U.S., with over 330 million people, there’s room for dozens of manufacturers. A single generic drug might have 15-20 makers competing. In Canada, it’s often just 3-4. PharmacyChecker’s 2023 study found that 88% of the top 34 generic drugs were cheaper in the U.S. On average, U.S. prices were 68% lower.But Canada Has Fewer Drug Shortages

Here’s where Canada’s system shines: stability. When a drug runs out, the U.S. often scrambles. Canada steps in. Health Canada doesn’t wait for hospitals to cry for help. It monitors supply chains, tracks production issues, and works with manufacturers to keep drugs flowing. In 2022, during the albuterol inhaler shortage, Canadian hospitals got priority access. Meanwhile, hospitals in Seattle and Chicago waited weeks. JAMA Network research found that sole-sourced drugs (those made by only one company) had 2.5 times higher risk of shortage in the U.S. than in Canada. Why? Because Canada’s system forces manufacturers to plan ahead. If a company wants to supply a drug to Canadian public plans, it has to guarantee consistent production. The U.S. system doesn’t require that. If a factory in India shuts down for a week, U.S. pharmacies might go dry. In Canada, backup suppliers are already lined up.

How Pharmacists Handle the Difference

If you’ve ever worked in a pharmacy, you know how much time goes into managing drug prices. Canadian pharmacists spend 5-7 hours a week just on pricing issues. They have to check which tier a drug is in, whether the province has a special formulary, and if the price just changed last week. It’s complex. U.S. pharmacists deal with something else: chaos. With dozens of insurers, each with their own formulary, they have to check if the patient’s plan covers the drug, which pharmacy they’re using, and whether GoodRx or a coupon will help. A 2023 survey found 63% of U.S. patients had to check 3 or more pharmacies to find the cheapest price. In Canada? Just 1.7 on average. Canadian pharmacists also deal with 30-day supply limits on many generics. That’s intentional. It reduces waste and prevents stockpiling. In the U.S., patients often get 90-day supplies, especially with private insurance. But that means more leftover pills and more pressure on supply chains.Real People, Real Costs

Reddit threads and pharmacy forums tell the real story. A user in Ontario paid $45 CAD for 90 days of generic atorvastatin. Their cousin in Ohio paid $12 for the same amount. That’s a 70% difference. But then there’s the flip side. A nurse in Calgary told a forum: “During the 2022 shortage, my hospital got supply. My sister’s hospital in Seattle didn’t get any for weeks.” Consumer ratings back this up. On PharmacyChecker.com, U.S. pharmacies average 4.7 out of 5 for generic drug service. Canadian pharmacies? 4.2. Why? Americans love low prices. Canadians? They value reliability. A 2023 Canadian Pharmacists Association survey found 68% of Canadians had no access issues with essential generics. In the U.S., it was 49%.

What’s Changing in 2025 and Beyond

Canada’s system is under pressure. The pCPA’s 2023 pricing agreement is only good for three years. After that, manufacturers may push back harder. The Conference Board of Canada predicts generic prices could rise 15-20% by 2025, especially if supply chain disruptions continue. Meanwhile, the U.S. is looking at importing drugs from Canada. Vermont, Colorado, and soon Florida have passed laws to let residents buy Canadian generics. But Canada doesn’t want that. In January 2023, it launched the Supply Chain Resilience Framework to stop exports that could cause domestic shortages. The U.S. government still hasn’t approved any official import program. Dr. Aisha Lofters from the University of Toronto warns: “Canada’s higher generic prices threaten the sustainability of its pharmacare model.” But Dr. Aaron Kesselheim from Harvard says: “The U.S. must fix its shortage problem-even if prices stay low.”Bottom Line: Trade-Offs, Not Winners

There’s no clear “better” system. The U.S. wins on price. Canada wins on reliability. One gives you cheaper pills. The other gives you fewer empty shelves. If you’re focused on cost, the U.S. wins. If you’re focused on access during a crisis, Canada wins. And if you’re trying to figure out which system your country should copy? That’s the real question.Canada doesn’t try to compete on price. It tries to compete on resilience. The U.S. doesn’t try to control supply. It tries to control cost. Both have trade-offs. Neither is perfect.

Catherine Wybourne

Honestly? This post nails it. Canada doesn’t do cheap - it does *reliable*. I’ve seen my mum wait weeks for insulin in the UK during shortages. Here? She got it. No drama. No panic. Just steady supply. Price? Yeah, it’s higher. But when your life depends on it, you don’t care about the sticker. You care about the shelf.

And let’s be real - if the U.S. could just fix its supply chain chaos, maybe we wouldn’t need to import from Canada at all. But we’re not there yet.